Planning a vacation on a limited budget can be overwhelming for Australian residents, especially with rising costs for flights, accommodation, and activities. Between soaring fuel prices and fluctuating exchange rates, it’s easy to feel like your dream holiday is slipping further out of reach.

However, learning how to create a travel budget that accounts for all expenses ensures you enjoy your trip without financial stress. This guide provides practical steps tailored for Aussies, from categorising expenses to estimating realistic costs and adding buffers for surprises, helping you align your dream getaway with your wallet in 2025.

Assess Your Financial Situation and Travel Goals

Before you can create a travel budget that works, you need a clear picture of your finances and what you want from your holiday. Start by evaluating your available funds, income, and savings as an Australian resident, then define your trip objectives like destination, duration, and type of experience you’re after.

Whether you’re dreaming of a budget Sydney to Melbourne road trip or an overseas Bali escape, setting realistic foundations is crucial. According to Tourism Australia data, the average Australian household spends approximately $4,500 annually on domestic travel and $6,200 on international trips. Understanding where you fit within these averages helps set realistic expectations.

Calculate Your Total Available Budget

Begin by reviewing your bank statements from the past three months to understand your spending patterns. Look at your income after tax, regular expenses, and what’s left over each month. The Australian Taxation Office’s MoneySmart budget planner is an excellent free tool that helps calculate your disposable income for travel.

Consider any upcoming expenses like car registration, insurance renewals, or Christmas spending that might affect your available travel funds. Don’t forget to factor in superannuation contributions and any salary sacrifice arrangements that impact your take-home pay.

If you’re planning an international trip, remember that accessing your super early for travel isn’t typically allowed under current regulations, so stick to readily available savings and income.

Define Clear Travel Objectives

Once you know your financial limits, prioritise what matters most for your trip. Create a list of must-haves versus nice-to-haves to guide your spending decisions. Must-haves might include flights and accommodation, while nice-to-haves could be fancy restaurants or premium tours.

Take the Johnson family from Brisbane, who wanted a Gold Coast holiday but only had $2,000 available. They prioritised accommodation near the beach and theme park tickets for the kids, while cutting back on dining out and choosing free beach activities over expensive water sports. This approach helped them enjoy a memorable week-long holiday within budget.

Categorise Your Travel Expenses Effectively

Breaking down expenses into clear categories helps you allocate your budget realistically and avoid nasty surprises. For Australian travellers, key categories include transportation, lodging, food, activities, and insurance, with each category typically representing different percentages of your total budget.

As a general guideline, consider allocating approximately 30-40% for accommodation, 25-35% for transportation, 15-25% for food, 10-15% for activities, and 5-10% for insurance and miscellaneous expenses. These percentages can vary significantly based on your travel style and destination.

Essential vs. Discretionary Costs

Fixed costs are non-negotiable expenses like flights, visa fees, and travel insurance that you must pay regardless of your travel style. Variable costs include meals, souvenirs, and optional activities where you have more control over spending.

Apps like Expense Manager or Trail Wallet help track both types of costs during your trip. Set up categories before you travel and input expenses daily to stay on track. This real-time monitoring prevents overspending in variable categories that can quickly blow your budget.

Understanding this distinction helps you make smart trade-offs. For instance, if flights cost more than expected, you might choose budget accommodation or cook some meals instead of dining out every night.

Account for Australian-Specific Expenses

Don’t overlook costs unique to Australian travellers. International trips require considering visa fees, which can range from $60 for a tourist visa to Bali to over $200 for some European destinations. Currency exchange rates also impact your purchasing power, especially with the Australian dollar’s fluctuations.

For domestic travel, factor in national park entry fees, which vary by state. A Great Ocean Road trip might include Port Campbell National Park fees, while a Kakadu adventure requires different permit costs. Research these specific charges early in your planning process.

Quarantine regulations, while less restrictive than during COVID-19, may still apply for certain destinations and could involve unexpected costs for testing or documentation.

Research and Estimate Costs Realistically

Accurate cost research prevents budget blow-outs and ensures your travel fund stretches as far as possible. Use Australian-specific resources and comparison sites to gather current pricing data, factoring in seasonal variations and inflation for 2025.

Skyscanner, Webjet, and Flight Centre offer comprehensive flight comparisons from Australian airports, while Booking.com, Wotif, and Stayz provide accommodation options with real guest reviews. For domestic travel, check state tourism websites for current attraction prices and seasonal deals.

According to recent Qantas and Virgin Australia reports, domestic return flights average $300-600 depending on the route, while international flights to popular destinations like Bali, Thailand, or New Zealand range from $600-1,500 return, varying significantly by season.

Use Reliable Tools and Resources

Government resources provide unbiased travel information and cost estimates. The Department of Foreign Affairs and Trade offers country-specific travel advisories with cost-of-living information, while MoneySmart’s travel calculator helps estimate realistic budgets.

Major Australian banks like CommBank, ANZ, and Westpac offer budget calculators and travel planning tools for customers. These often include currency converters and spending trackers specifically designed for Australian travellers.

Avoid relying solely on travel blogs or outdated guidebooks for cost estimates. Instead, cross-reference multiple current sources and check recent reviews on platforms like TripAdvisor or Google Reviews for up-to-date pricing information.

Build in Flexibility for Fluctuations

Exchange rates, fuel prices, and seasonal demand can significantly impact travel costs. When budgeting for international trips, monitor currency trends for several months before booking and consider purchasing foreign currency when rates are favourable.

For example, if planning a New Zealand South Island road trip, the Australian dollar’s strength against the New Zealand dollar affects everything from accommodation to petrol costs. A 10% currency fluctuation could add or save hundreds of dollars on a two-week holiday.

Book flexible accommodation and transport options when possible, allowing you to adjust plans if costs change. Many hotels offer free cancellation within 24-48 hours, giving you time to find better deals.

Incorporate Buffer Funds for Unexpected Events

Even the best-planned trips encounter surprises, making contingency funds essential for stress-free travel. Add 10-20% of your total budget for emergencies like medical issues, flight delays, or unexpected accommodation changes.

Australian travellers should consider travel insurance from providers like Allianz, Cover-More, or TID, which typically costs 3-5% of your trip value. This investment can save thousands if serious problems arise.

Consider Sarah from Melbourne, who budgeted $3,000 for a European adventure but set aside an additional $500 buffer. When her return flight was cancelled due to strikes, she used buffer funds for an extra night’s accommodation and rebooking fees without panicking or going into debt.

Identify Common Unforeseen Expenses

Weather disruptions, lost luggage, medical emergencies, and transport strikes are common travel complications. Calculate buffer amounts based on your trip length and destination risk level – remote areas or countries with less reliable infrastructure require larger contingencies.

For domestic Australian travel, common unexpected costs include vehicle breakdowns on road trips, accommodation availability issues during school holidays, or weather-related activity cancellations. International travel adds risks like political situations, natural disasters, or sudden quarantine requirements.

Budget approximately $50-100 per day for minor emergencies and $500-1,000 for major disruptions, depending on your destination and trip length.

Integrate Insurance and Emergency Planning

Choose comprehensive travel insurance that covers medical expenses, trip cancellation, lost luggage, and rental car excess. Compare policies carefully, as cheaper options often exclude important coverage areas.

Set aside emergency funds separate from your travel insurance. Keep some cash accessible for immediate needs, while maintaining access to additional funds through credit cards or online banking. Notify your bank of travel plans to prevent card blocking at crucial moments.

Australian consumer protections apply to travel purchases made within Australia, providing additional recourse if things go wrong with local travel agents or tour operators.

Track, Review, and Adjust Your Travel Budget

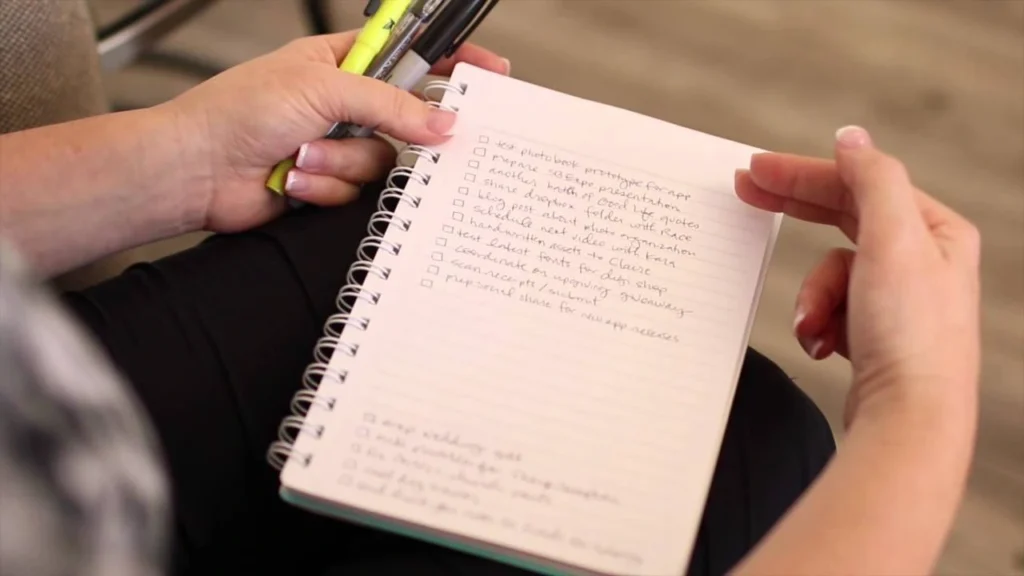

Monitoring your spending during travel keeps you on track and provides valuable data for future trips. Use apps, spreadsheets, or simple notebooks to record expenses daily, making adjustments as needed to avoid budget overruns.

Post-trip reviews help refine your budgeting skills and identify areas for improvement. This ongoing process makes each subsequent holiday more affordable and enjoyable as you learn what works for your travel style and financial situation.

Choose the Right Tracking Tools

PocketGuard, Trail Wallet, and Toshl are user-friendly apps designed for travel expense tracking. Set up categories matching your budget breakdown and input purchases immediately to maintain accuracy.

Excel or Google Sheets templates work well for detailed tracking and analysis. Create columns for planned versus actual spending in each category, helping identify where estimates were accurate or needed adjustment.

For example, Mark from Perth used a simple smartphone app during his Thailand holiday and discovered he was spending 40% more on food than budgeted but 30% less on activities. He adjusted spending patterns mid-trip, finishing within his overall budget while still enjoying great meals.

Learn from Your Budgeting Experience

After returning home, compare your actual expenses against planned amounts in each category. Identify which estimates were accurate and which need adjustment for future trips. This analysis improves your budgeting accuracy over time.

Consider the Taylor couple from Adelaide, who overspent by 15% on their first international trip but used lessons learned to save 20% on their next holiday through better planning and realistic expectations.

Keep a travel budget journal noting what worked well, what didn’t, and specific costs for future reference. This personal database becomes invaluable for planning similar trips or helping friends with their travel budgets.

Conclusion

By following these practical steps to create a travel budget, Australian residents can confidently plan vacations that fit their limited funds while minimising stress from unexpected costs. The key is starting with honest financial assessment, categorising expenses realistically, researching costs thoroughly, and building in appropriate buffers for surprises.

Start building your budget today using these outlined strategies, and remember that successful travel budgeting is a skill that improves with practice. Each trip teaches valuable lessons that make future holidays more affordable and enjoyable.

Ready to put your budget into action? Explore our comprehensive guide on planning budget-friendly trip to any destination in 2025 for more tips to make your next adventure both affordable and memorable. Share your own budgeting successes in the comments below – your experience could help fellow Aussie travellers plan their perfect getaway.