Life insurance pays a lump sum when you die or are diagnosed with a terminal illness. Income protection replaces up to 75% of your salary if injury or illness stops you from working. Many working Australians need both to protect their family and their income during different life events.

- What Is Life Insurance (in Australia)?

- What Is Income Protection Insurance (in Australia)?

- Key Differences Between Life Insurance and Income Protection

- Why You Might Need Both (or Just One)

- Real-World Australian Context and Data

- Conclusion

- FAQs

- Can you have income protection without life insurance in Australia?

- Does income protection cover pre-existing conditions?

- Can you claim both life insurance and income protection at the same time?

- How does switching from super-based cover to a standalone policy work?

- Are mental health conditions covered under income protection?

You work hard to support yourself and your family. But what happens if you can’t work anymore — or worse, if you’re no longer here?

That’s where insurance comes in. Life insurance protects your loved ones financially if you die. Income protection keeps money coming in if illness or injury stops you from earning. Both sound important, but they work in very different ways.

This guide breaks down life insurance vs income protection Australia — what each does, how they differ, and which one (or both) makes sense for your situation. You’ll also see real Australian claim data and tax rules that affect your premiums and payouts.

What Is Life Insurance (in Australia)?

Life insurance pays a lump sum to your beneficiaries when you die or are diagnosed with a terminal illness. It’s designed to replace lost income, pay off debts like a mortgage, and cover funeral costs.

Most Australian life insurance policies include death cover and terminal illness cover. Some also offer optional extras like trauma cover or total and permanent disability (TPD) cover.

You can buy life insurance directly from an insurer or hold it inside your superannuation fund. Many Australians get default life cover through super without realising it.

What Triggers a Payout

Life insurance pays out when you die or receive a terminal illness diagnosis from a qualified medical specialist. Terminal illness typically means you’re expected to live less than 12 or 24 months (depending on the policy).

The payout is tax-free and goes to your nominated beneficiaries. They can use the money however they need — whether that’s paying off the mortgage, covering living expenses, or funding their children’s education.

If you hold life cover through super, the payout goes to your super fund first, then to your beneficiaries according to your nomination or the fund’s rules.

How Much Life Cover Australians Typically Take

The Insurance Council of Australia reports that the average life insurance benefit sits around $300,000 to $500,000. But needs vary widely based on your income, debts, and dependents.

A single person with no mortgage might only need enough to cover funeral costs (around $15,000 to $20,000). A parent with young kids and a $600,000 mortgage needs far more — often $1 million or higher.

Many Australians underestimate how much cover they need. A common rule of thumb is 10 times your annual income, but your personal situation matters more than any formula.

What Is Income Protection Insurance (in Australia)?

Income protection insurance pays you a regular monthly benefit if you can’t work due to illness or injury. It replaces part of your salary — usually 70% to 75% — until you can return to work or the policy ends.

Unlike life insurance, income protection keeps money flowing while you’re alive but unable to earn. It covers your rent or mortgage, groceries, school fees, and other everyday expenses.

You can buy income protection as a standalone policy or through your super fund. Standalone policies give you more control over policy terms and payout rates.

Key Features: Waiting Period, Benefit Period, Payout Rate

Three main features shape how income protection works:

- Waiting period — This is how long you wait after becoming unable to work before payments start. Common waiting periods are 14, 30, 60, or 90 days. Shorter waiting periods cost more.

- Benefit period — This is how long the policy pays you. Options range from two years to age 65. Longer benefit periods mean higher premiums but better protection.

- Payout rate — Most policies pay 70% to 75% of your pre-tax income, capped at a maximum monthly amount (often $30,000). Some policies offer agreed value (fixed amount) or indemnity value (based on actual income at claim time).

Who It’s For

Income protection suits anyone who relies on their salary to pay bills. It’s especially valuable if you:

Have limited sick leave or no paid leave at all. Most Australian employees get 10 days of personal leave per year, but that runs out fast during serious illness.

Are self-employed. You don’t get sick leave when you work for yourself. Income protection becomes your safety net.

Have a mortgage or high living costs. If you can’t work for six months, how will you pay your mortgage? Income protection answers that question.

Work in a physically demanding or high-risk job. Tradies, healthcare workers, and manual labourers face higher injury risks than office workers.

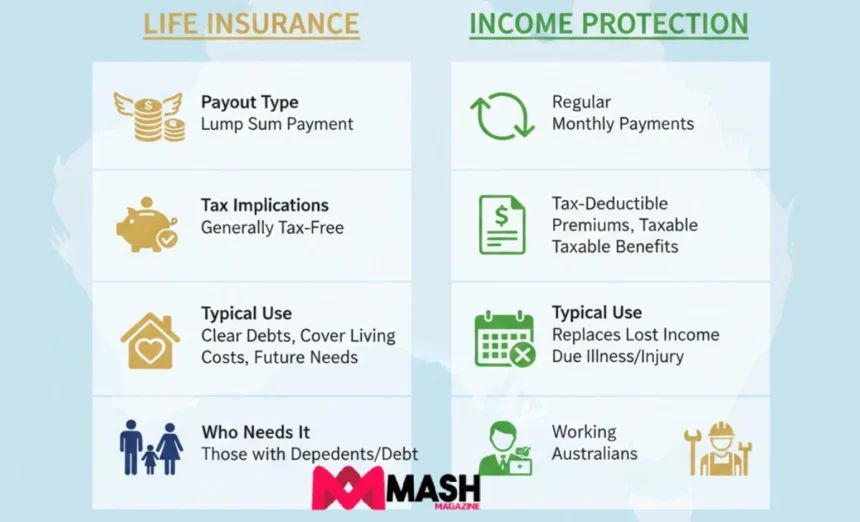

Key Differences Between Life Insurance and Income Protection

Life insurance and income protection protect against different risks. Here’s how they compare.

Payment Structure

Life insurance pays a one-time lump sum when you die or are diagnosed with terminal illness. Your family gets the full amount at once.

Income protection pays monthly benefits while you’re unable to work. Payments continue until you recover, return to work, or reach the end of your benefit period.

You can think of life insurance as a final safety net for your family. Income protection is more like a salary replacement plan for yourself.

Tax Implications

Income protection premiums are usually tax-deductible when you hold the policy personally (outside super). That means you can claim the cost on your tax return.

But there’s a trade-off. Income protection benefits are taxable as income. If you receive $5,000 per month, you’ll pay tax on that amount just like regular wages.

Life insurance premiums are not tax-deductible, whether you hold the policy personally or through super. But the payout is tax-free to your beneficiaries.

If you hold income protection through super, premiums reduce your super balance but aren’t deductible on your personal tax return. Benefits may also be taxed differently depending on your age and how the payout is structured.

Policy Duration and Entry Age

Life insurance typically covers you until age 99 or for your whole life, depending on the policy type. You can take out life cover at almost any age, though premiums increase as you get older.

Income protection usually ends between age 60 and 70. Insurers assume you’ll retire around that time, so they stop income replacement then. Most insurers won’t sell you income protection after age 60 to 65.

This makes sense when you think about it. Life insurance protects against death, which can happen at any age. Income protection replaces salary, which you stop earning when you retire.

Why You Might Need Both (or Just One)

The right insurance mix depends on your life stage, financial commitments, and personal risks. Here’s how to think through your situation.

When Life Insurance Is Most Important

Life insurance becomes critical when other people depend on your income. If you died tomorrow, could your family maintain their lifestyle, pay the mortgage, and cover education costs?

- Parents with young children — Your kids need financial support until they finish school and become independent. Life insurance replaces decades of lost income.

- Anyone with a mortgage — Your partner shouldn’t inherit your debt. Life insurance pays off the home loan so your family keeps the house.

- Business owners with partners — If you co-own a business, life insurance can buy out your share so your family gets fair value and your partner can continue operating.

- Single people with no dependents — You might only need enough to cover funeral costs and any remaining debts. Some choose to skip life insurance altogether in this situation.

When Income Protection Might Be a Priority

Income protection matters most when you can’t afford to stop earning. Ask yourself: could you cover six months of expenses without your salary?

- Self-employed workers — No sick leave means no income when you’re unwell. Income protection fills that gap.

- High income earners — If you earn $150,000 per year, losing that income hurts more than someone earning $60,000. Income protection maintains your lifestyle during recovery.

- Limited emergency savings — Most financial experts recommend three to six months of expenses in savings. If you don’t have that buffer, income protection becomes more important.

- Risky occupations — Electricians, nurses, construction workers, and other hands-on roles face higher injury risks. Income protection is smart insurance.

Real-World Australian Context and Data

Let’s look at actual claim numbers and how super affects your insurance choices.

Claim Statistics and Trends

TAL’s 2023-24 claims report shows that income protection claims made up 28% of all claims by number but only 15% by value. Life insurance claims were fewer but larger — death and terminal illness claims averaged over $400,000 each.

The most common income protection claims came from mental health conditions (31%), musculoskeletal issues like back injuries (23%), and cancer (12%). These numbers matter because they show what actually stops Australians from working.

TAL paid 94% of income protection claims and 98% of life insurance claims. Declined claims usually failed because the condition wasn’t covered or the person didn’t meet policy definitions.

Role of Superannuation in Cover

Many Australians hold default life and TPD cover through their super fund. This cover is automatic when you join the fund, though you can adjust or cancel it.

Super-based insurance has upsides and downsides. On the plus side, premiums come from your super balance, not your take-home pay. You don’t feel the cost each month.

On the downside, insurance premiums reduce your retirement savings. If you’re young, those small deductions compound over decades and can cost you tens of thousands in retirement.

Income protection through super is less common than life cover. Some super funds offer it, but coverage limits and policy terms are often more restrictive than standalone policies.

If you have cover through super, check whether it matches your actual needs. Default cover amounts are usually modest — often $50,000 to $200,000 for life insurance, which might not be enough if you have dependents and a mortgage.

Conclusion

Life insurance and income protection serve different but equally important roles. Life insurance protects your family if you die. Income protection protects your income if you can’t work.

For most working Australians, the smartest approach combines both. Life cover gives your family security. Income protection gives you security.

Start by reviewing any insurance you already hold through your super fund. Check the coverage amounts, policy terms, and whether they actually match your needs. Then compare standalone policies to see if you need more cover or better terms.

If you’re not sure where to start, talk to a licensed financial adviser or insurance broker. They can help you calculate how much cover makes sense for your income, debts, and life stage.

Don’t wait until it’s too late. Get your cover sorted now so you can focus on what matters — your work, your family, and your future.

FAQs

Can you have income protection without life insurance in Australia?

Yes, standalone income protection policies are available and are often recommended for those with sufficient life cover through super or other arrangements.

Does income protection cover pre-existing conditions?

Most policies exclude pre-existing conditions or impose waiting periods, so it’s essential to disclose all medical history when applying.

Can you claim both life insurance and income protection at the same time?

Yes, if you meet the conditions of each policy. For example, income protection could pay while you’re ill, and life insurance could pay if a terminal illness diagnosis occurs.

How does switching from super-based cover to a standalone policy work?

You usually need to apply for a new policy, pass underwriting, and then cancel super-based cover. Premiums are separate, and benefits may be higher.

Are mental health conditions covered under income protection?

Many policies do cover mental health, but waiting periods may be longer and payout rules stricter. Always check the Product Disclosure Statement (PDS) carefully.