Getting your car insurance claim rejected feels like a punch to the gut. You’ve paid your premiums faithfully, followed the rules, and now when you need help most, your insurer says no.

- Why car insurance claims get denied in Australia — common causes

- Your car insurance claim was denied, Australia’s rights under consumer law

- First steps after your claim is denied

- How to appeal a denied car insurance claim

- Escalating to AFCA and other authorities

- Practical tips to prevent claim denials in the future

- FAQs

- Can I get legal help for a denied claim?

- How long do appeals take in Australia?

- Do I need a lawyer for AFCA complaints?

- What if my insurer goes out of business during my appeal?

- Can I claim through someone else’s insurance if mine is denied?

- Will appealing a denied claim affect my future premiums?

- Taking action on your denied claim

You’re not powerless. Australian consumers have strong rights when their car insurance claim is denied. The system includes clear appeal processes, free dispute resolution services, and legal protections designed to keep insurers accountable.

This guide walks you through your options, explains your rights under Australian law, and gives you the practical steps to fight back against an unfair denial.

Why car insurance claims get denied in Australia — common causes

Understanding why insurers reject claims helps you avoid pitfalls and strengthens your appeal case when your car insurance claim is denied in Australia.

Non-disclosure tops the rejection list. When you apply for car insurance, you must tell your insurer about anything that could affect your risk. This includes previous accidents, driving offences, modifications to your vehicle, or changes to where you park overnight. Even innocent omissions can void your policy.

Policy exclusions catch many drivers off guard. Your Product Disclosure Statement (PDS) lists what’s not covered. Common exclusions include driving under the influence, using your car for business without commercial cover, or damage from floods if you don’t have comprehensive insurance.

Late reporting creates problems too. Most policies require you to notify your insurer “as soon as reasonably practicable” after an incident. What seems reasonable to you might not align with your insurer’s expectations.

The Insurance Council of Australia reports that disputed claims often involve these same issues. A typical denial letter might state: “Your claim has been declined as the damage occurred while your vehicle was being used for courier services, which is excluded under Section 4.2 of your PDS.”

Key denial reasons include driving under the influence of alcohol or drugs, using your vehicle outside policy terms, pre-existing damage not reported, and fraudulent or exaggerated claims. Failure to disclose relevant information remains the most common cause across all Australian insurers.

Your car insurance claim was denied, Australia’s rights under consumer law

Australian law gives you significant protection when dealing with insurance disputes. These rights aren’t suggestions — they’re legal requirements your insurer must follow.

The Insurance Contracts Act 1984 forms the backbone of your protection. This federal law requires insurers to act with “utmost good faith,” meaning they must be honest, transparent, and fair in their dealings with you. They can’t use technical loopholes to avoid legitimate claims.

Australian Consumer Law adds another layer of protection. Under this framework, insurers must provide services with due care and skill. If they breach this duty, you have grounds for compensation beyond just your original claim.

Your insurer must explain its decision clearly. When they deny your claim, they’re legally required to give you specific reasons in plain English. Vague responses like “claim not covered” don’t meet this standard.

Consider the recent AFCA case where a Sydney driver’s claim was initially denied for “non-disclosure.” The customer had mentioned a minor accident during the phone application, but the insurer’s call centre didn’t record it properly. AFCA overturned the denial and ordered the insurer to pay the claim plus $2,000 for the customer’s distress and inconvenience.

Your legal protections include the right to clear explanations for claim denials, protection against unfair contract terms, and access to free dispute resolution through AFCA. The law also requires insurers to handle your complaint within reasonable timeframes and provide regular updates on progress.

First steps after your claim is denied

Acting quickly and methodically after receiving a denial gives you the best chance of overturning the decision.

Read the insurer’s denial letter carefully. Look for the specific reason they’ve given and note any reference to sections of your PDS. The insurer must cite exact policy terms or legal provisions that support their decision. If they haven’t done this, you have grounds for appeal.

Compare the denial reason with your Product Disclosure Statement. Get out your original policy documents and check whether the insurer’s interpretation matches what’s actually written. Sometimes insurers apply exclusions too broadly or misinterpret policy terms.

Collect all relevant evidence immediately. This includes photos of the damage, police reports, repair quotes, witness statements, and any correspondence with your insurer. The more documentation you have, the stronger your position becomes.

Review your original application and any subsequent changes you’ve made to your policy. Check whether you disclosed everything properly and whether the insurer has all current information about your circumstances.

Contact the other party’s insurer if your claim involves another vehicle. Sometimes you can pursue compensation through their insurer even if yours has denied your claim. This is particularly relevant in situations where the other driver was clearly at fault.

Document everything from this point forward. Keep records of phone calls, emails, and letters. Note the dates, times, and names of people you speak with. This documentation becomes crucial if you need to escalate your complaint.

How to appeal a denied car insurance claim

Most claim disputes are resolved through your insurer’s Internal Dispute Resolution process before reaching external authorities.

Start by lodging a formal complaint with your insurer’s complaints department. Don’t just call — put your complaint in writing. Email works fine, but keep a copy of everything you send. Your insurer must acknowledge your complaint within one business day and provide a reference number.

Structure your appeal letter effectively. State clearly that you’re disputing the claim denial, reference your policy number and claim number, and explain why you believe the decision is wrong. Include copies of supporting evidence and specify what outcome you’re seeking.

Your insurer has 30 days to investigate and respond to your complaint. This isn’t 30 business days — it’s 30 calendar days from when they receive your complaint. If they need more time, they must explain why and give you a revised timeframe.

Many disputes are resolved at this stage because the complaints team often takes a fresh look at your case. They might have access to senior claims assessors who can overturn the original decision. Statistics from ASIC show that around 60% of insurance complaints are resolved through internal dispute resolution.

Keep detailed records of all communications during this process. If the insurer phones you, follow up with an email summarising what was discussed. This creates a paper trail that protects you if the matter escalates further.

If your insurer maintains its denial after 30 days, it must provide you with information about external dispute resolution. This is your cue to consider taking the matter to AFCA if you’re not satisfied with their final response.

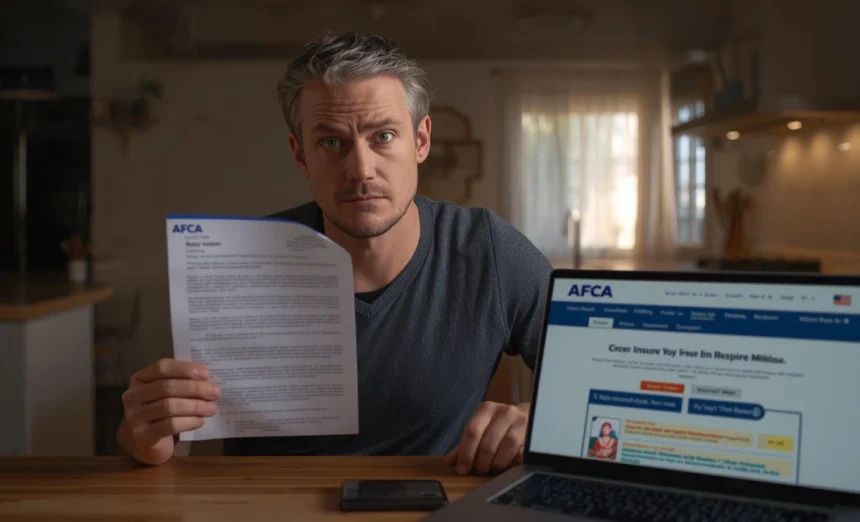

Escalating to AFCA and other authorities

When internal dispute resolution fails, the Australian Financial Complaints Authority becomes your next port of call.

AFCA is a free, independent service that resolves disputes between consumers and financial services providers. They can order your insurer to pay your claim, provide compensation for delays and distress, or require the insurer to change their processes.

Lodge your AFCA complaint online through their website. You’ll need your insurer’s final response letter and copies of all relevant documents. AFCA won’t investigate your complaint until your insurer has had a chance to resolve it internally, so make sure you’ve completed that process first.

AFCA has broader powers than your insurer’s complaints team. They can award compensation up to $1.08 million for insurance disputes and can order payments for financial loss, inconvenience, and distress. Strict legal technicalities do not bind them, and they can consider what’s fair and reasonable in your circumstances.

The AFCA process typically takes 6-12 months, but many cases resolve sooner through conciliation. Your insurer often settles once AFCA gets involved because they know the odds favour consumers in legitimate disputes. Recent AFCA statistics show consumers succeed in around 70% of insurance disputes.

ASIC provides additional support for systemic issues. If you believe your insurer is regularly denying legitimate claims or engaging in unfair practices, report this to ASIC. They can investigate and take enforcement action against insurers who breach their obligations.

State consumer affairs departments also offer assistance. They can’t override your insurer’s decision, but they can provide advice and support throughout the process. Some states also maintain databases of complaint patterns that help identify problematic insurers.

Practical tips to prevent claim denials in the future

Prevention remains better than cure when it comes to insurance claim disputes.

Full disclosure at application time protects you from non-disclosure allegations later. Tell your insurer about every accident, traffic violation, and claim you’ve made in the past five years, even if they seem minor. It’s better to pay slightly higher premiums than have a major claim denied.

Keep your policy updated whenever your circumstances change. Moving house, changing jobs, modifying your vehicle, or adding new drivers all affect your risk profile. Most insurers allow you to make these changes online or over the phone at no extra cost.

Understand your policy exclusions before you need to claim. Read your PDS carefully and ask questions about anything unclear. Many drivers assume they have comprehensive cover only to discover important exclusions when they claim. Pay particular attention to exclusions around business use, racing, and flood damage.

Report incidents promptly even if you don’t plan to claim immediately. Many policies require notification “as soon as practicable” regardless of whether you’re making a claim. A quick phone call or online report protects your position if you later decide to claim.

The MoneySmart.gov.au website provides excellent guidance on choosing and managing car insurance. Their comparison tools help you understand different policy features and exclusions before you buy. This government resource remains completely independent and focuses on consumer protection.

Take photos after any incident, even minor ones. Modern smartphones make it easy to document damage, vehicle positions, and road conditions. These photos become invaluable evidence if disputes arise later about the cause or extent of damage.

FAQs

Can I get legal help for a denied claim?

You can hire a lawyer, but it’s rarely necessary for standard disputes. AFCA provides free resolution services that are often more effective than legal action. Consider legal advice only for complex cases involving significant amounts or if you’re considering court action.

How long do appeals take in Australia?

Internal dispute resolution takes up to 30 days. If you escalate to AFCA, expect 6-12 months for a final decision, though many cases settle sooner. Time limits exist to protect consumers, and insurers face penalties for unreasonable delays.

Do I need a lawyer for AFCA complaints?

No, AFCA complaints are designed for consumers to handle themselves. The process is informal and AFCA staff help you present your case. Legal representation can actually slow things down and won’t improve your chances of success in most cases.

What if my insurer goes out of business during my appeal?

The Insurance Council of Australia’s General Insurance Code of Practice requires insurers to maintain arrangements for handling claims even if they stop writing new business. APRA also oversees insurer financial stability to prevent sudden collapses.

Can I claim through someone else’s insurance if mine is denied?

Yes, if another driver was at fault in an accident, you can claim through their insurer regardless of your own claim status. This is called a third-party claim and operates independently of your own insurance policy.

Will appealing a denied claim affect my future premiums?

No, legitimate appeals don’t affect your premiums or renewability. Insurers can’t penalise customers for exercising their rights to dispute decisions. However, multiple claims over time will impact your premiums regardless of whether any were initially denied.

Taking action on your denied claim

A denied car insurance claim in Australia doesn’t mark the end of your road to compensation. The system provides multiple pathways to challenge unfair decisions, and consumer rights remain strongly protected under Australian law.

Start with internal dispute resolution through your insurer’s complaints process. Most disputes resolve at this stage once a fresh pair of eyes reviews your case. If that fails, AFCA offers free, independent dispute resolution with the power to order insurers to pay legitimate claims.

Your rights remain protected throughout this process. Insurers must treat you fairly, explain their decisions clearly, and respond to complaints within set timeframes. Document everything, keep copies of all correspondence, and don’t accept vague explanations for denials.

Check your denial letter against your PDS today. Compare the reasons given with your actual policy terms and start gathering your evidence. The sooner you act, the stronger your position becomes for overturning an unfair denial.