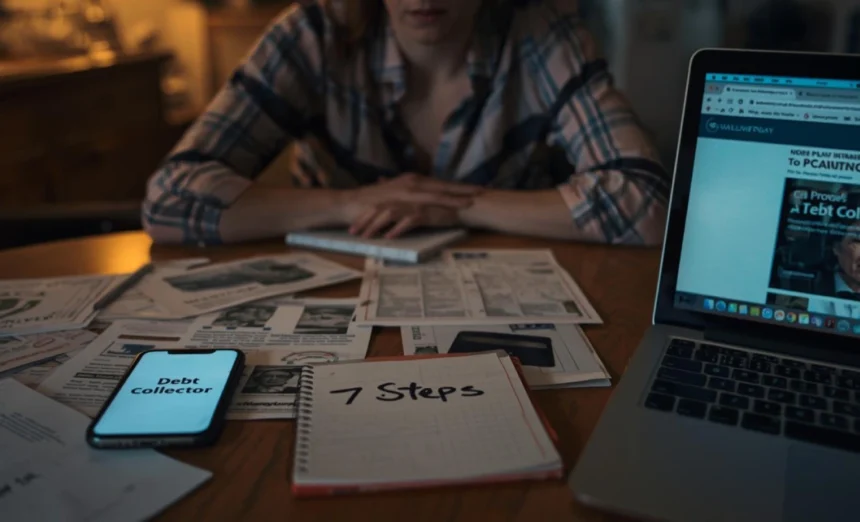

Receiving a call from debt collectors can be stressful and intimidating, but it’s important to stay calm – you have strong legal protections under Australian law. Whether the debt is legitimate or disputed, understanding your debt collectors Australia rights is crucial to avoiding harassment and resolving the situation properly.

- What Debt Collectors Can and Cannot Do: Your Rights Explained

- Step 1: Verify the Debt – Initial Script and What to Ask

- Step 2: Dispute the Debt in Writing

- Step 3: Record, Preserve Evidence and Document Everything

- Step 4: Negotiate Payment Plans and Hardship Assistance

- Step 5: Lodge Complaints When Collectors Breach Rules

- Step 6: AFCA and Tribunal Options – When to Escalate Further

- Step 7: Long-term Protection and Credit File Management

- FAQs

- Can debt collectors contact me at work or speak to family members?

- How long do debt collectors have to pursue a debt in Australia?

- What happens if I ignore debt collectors completely?

- Can debt collectors take money directly from my bank account?

- Do I have to pay collection agency fees on top of the original debt?

- Conclusion

Many Australians don’t realise they can verify debts, dispute incorrect amounts, and take action against collectors who breach regulations. This guide provides a complete 7-step response plan, including phone scripts, dispute letter templates, and clear guidance on when to escalate to AFCA or consumer tribunals.

From your first conversation through to final resolution, these practical steps will help you protect yourself and ensure debt collectors follow the law.

What Debt Collectors Can and Cannot Do: Your Rights Explained

Understanding the boundaries of debt collection is essential for protecting yourself from illegal practices. Under Australian Consumer Law and the Australian Securities and Investments Commission (ASIC) guidelines, debt collectors must follow strict rules when contacting you.

What Debt Collectors Can Do:

- Contact you by phone, email, or letter during reasonable hours (8 am-9 pm weekdays, 9 am-9 pm weekends)

- Request payment of legitimate debts

- Provide information about the debt and payment options

- Report defaults to credit agencies after proper notice

- Commence legal proceedings for unpaid debts

What Debt Collectors Cannot Do:

- Call repeatedly or outside permitted hours

- Use threatening, intimidating, or abusive language

- Threatened to seize property without court orders

- Discuss your debt with unauthorized third parties

- Misrepresent the consequences of non-payment

- Continue contacting you after written requests to stop

Common illegal tactics reported to ASIC include collectors threatening immediate property seizure, claiming false legal authority, or making excessive daily contact attempts. If collectors engage in any prohibited behavior, you have grounds for formal complaints and potential compensation.

Recording Interactions: In most Australian states, you can legally record conversations if you’re a party to the call. This evidence can be valuable if you need to prove harassment or false statements later.

Step 1: Verify the Debt – Initial Script and What to Ask

Never admit to owing money or make payment promises during the first contact. Your priority is verifying that the debt is legitimate and accurate. Use this proven script to gather essential information:

Initial Contact Script: “I’m not admitting this debt is mine. Before we proceed, I need you to provide:

- Your full company name and contact details

- The original creditor’s name

- The account number

- The exact amount claimed

- A breakdown of any fees or interest added

- Written verification sent to my address within 7 days

I won’t discuss payment until I receive this information in writing.”

Voicemail Version: “This is [your name]. I dispute this debt and require written verification before any discussion. Send details to [your address].”

Key Information to Request:

- Original creditor name and account number

- Date of last payment made

- Itemized breakdown of current balance

- Copy of original agreement or contract

- Statement showing how the debt was calculated

- Authority to collect on behalf of the creditor

Most legitimate collectors can provide this information immediately. If they refuse or become evasive, this may indicate the debt is disputed, incorrect, or the collector lacks proper authority.

Red Flags During Initial Contact:

- Pressure to pay immediately over the phone

- Refusal to provide written verification

- Claims that requesting information will result in immediate legal action

- Inability to provide basic account details

Step 2: Dispute the Debt in Writing

Written disputes create a permanent record and trigger legal obligations for collectors to verify debts before continuing collection efforts. Here are two ready-to-use templates for common situations:

Template A: Debt Identity Dispute

Subject: Debt Dispute – Not My Debt

[Date]

[Collector Company Name] [Address]

Reference: Account #[Number if known]

Dear Sir/Madam,

I am writing to formally dispute the debt you have claimed against me for $[amount]. This debt is not mine, and I believe there has been an identity error.

Reasons for Dispute:

- I have no record of any account with [original creditor name]

- I have never received goods or services from this company

- The debt may belong to someone with a similar name

Request for Evidence: Please provide complete documentation proving I am liable for this debt, including:

- Original signed agreement or contract

- Statements showing debt accumulation

- Verification of my identity linked to this account

Until you provide this evidence, cease all collection activity. Under Australian Consumer Law, continued collection of disputed debts may constitute harassment.

Yours sincerely, [Your name] [Your address] [Your contact details]

Template B: Amount/Fees Dispute

Subject: Dispute of Debt Amount and Charges

[Date]

[Collector Company Name] [Address]

Reference: Account #[Number]

Dear Sir/Madam,

I acknowledge there may be a debt owed to [original creditor], however I dispute the current amount of $[amount] being claimed.

Basis of Dispute:

- The original debt was approximately $[amount]

- The additional charges appear excessive and unjustified

- Some fees may have been added incorrectly

Documentation Required:

- Complete payment history from account opening

- Breakdown of all fees and charges applied

- Legal basis for each additional charge

- Interest calculation method

I am prepared to resolve any legitimate debt, but I require full transparency about how the claimed amount was calculated. Please pause collection activity until this dispute is resolved.

Yours sincerely, [Your name] [Your address] [Your contact details]

Evidence to Include:

- Copies of bank statements showing payments made

- Screenshots of original account balances

- Previous correspondence about the debt

- Any receipts or proof of payment

Step 3: Record, Preserve Evidence and Document Everything

Comprehensive record-keeping is essential for protecting your rights and building a strong case if you need to escalate complaints. Courts and ombudsman services rely heavily on documented evidence when resolving disputes.

What to Document:

- Phone Calls: Date, time, caller name, company, conversation summary

- Written Communications: Save all letters, emails, and text messages

- Payment History: Bank statements, receipts, transaction records

- Online Activity: Screenshots of account portals or debt collector websites

Legal Recording Guidelines:

- Most states allow one-party consent recording (you can record calls you’re part of)

- Inform the collector you’re recording: “This call is being recorded for accuracy.”

- Store recordings securely and create backup copies

- Note: Queensland requires all parties to consent unless recording for legal protection

Evidence Organization System: Create folders for:

- Original debt documentation

- Collector correspondence

- Phone call logs and recordings

- Financial records and payments

- Complaint responses and outcomes

Timeline Creation: Maintain a chronological record showing:

- When debt was first disputed

- Collection attempts and your responses

- Any harassment or rule violations

- Steps taken to resolve the matter

This evidence becomes crucial if you need to prove harassment, dispute incorrect amounts, or demonstrate that collectors failed to verify debts properly.

Step 4: Negotiate Payment Plans and Hardship Assistance

If the debt is legitimate but you cannot pay the full amount, Australian law provides several options for managing repayment. Many collectors prefer negotiated settlements over lengthy legal proceedings.

Negotiation Script: “I acknowledge this debt and want to resolve it responsibly. Due to financial hardship, I can afford $[amount] per [week/fortnight/month]. Can we arrange a payment plan with the following terms:

- No additional fees or interest during the plan

- Written agreement confirming the arrangement

- Removal of any default listing upon completion

- No contact from other collectors during compliance.”

Payment Plan Proposal Elements:

- Affordable Amount: Based on your actual budget capacity

- Payment Frequency: Weekly, fortnightly, or monthly options

- Duration: Realistic timeframe for full repayment

- Fee Freeze: Request suspension of interest and charges

- Credit Protection: Ask for default listing removal or prevention

Hardship Assistance Options:

- Temporary Payment Suspension: During illness, unemployment, or crisis

- Reduced Payment Plans: Lower amounts over extended periods

- Settlement Offers: One-time payment less than the full debt

- Fee Waivers: Removal of collection charges and late fees

What to Say vs What NOT to Say:

| Effective Phrases | Avoid These Phrases |

|---|---|

| “I want to resolve this responsibly.” | “I can’t pay anything.” |

| “Here’s what I can realistically afford” | “This isn’t fair.” |

| “Can we put this agreement in writing?” | “I’ll pay when I can.” |

| “I’m experiencing genuine hardship.” | “You people are harassing me.” |

Written Confirmation: Always request written confirmation of any payment arrangement, including specific terms, consequences of missed payments, and agreement that the plan satisfies the debt obligation.

Step 5: Lodge Complaints When Collectors Breach Rules

When debt collectors violate regulations or continue pursuing disputed debts, you have several complaint pathways depending on the type of violation and collector involved.

Australian Financial Complaints Authority (AFCA):

- When to Use: For banks, finance companies, credit providers, and licensed debt collectors

- Cost: Free service for consumers

- Typical Remedies: Compensation, debt reduction, removal of default listings

- Time Limit: Generally within 2 years of the issue

Australian Securities and Investments Commission (ASIC):

- When to Use: Serious regulatory breaches, unlicensed collection activity

- Focus: Industry-wide issues, licensing violations

- Outcome: Regulatory action against companies, not individual compensation

State Fair Trading Offices:

- When to Use: Consumer protection violations, misleading conduct

- Services: Mediation, advice, local enforcement action

- Examples: NSW Fair Trading, Consumer Affairs Victoria

Police Reports:

- When to Use: Threats of violence, fraud, identity theft

- Criminal Matters: Extortion, stalking, harassment beyond civil disputes

Complaint Escalation Process:

- Internal Complaint: Contact the collector’s complaints department first

- External Body: AFCA, ASIC, or Fair Trading within 45 days

- Legal Action: Tribunal or court if other methods fail

Evidence Required for Complaints:

- Documentation of rule violations

- Records of unsuccessful internal complaints

- Financial impact statements

- Communication showing the collector’s non-compliance

Step 6: AFCA and Tribunal Options – When to Escalate Further

Understanding when to use AFCA versus consumer tribunals helps you choose the most effective resolution path for your specific situation.

AFCA (Australian Financial Complaints Authority):

- Scope: Credit providers, banks, licensed debt collectors, and finance companies

- Monetary Limit: Up to $500,000 for most disputes

- Timeline: Usually 30-90 days for straightforward cases

- Remedies: Compensation, debt write-offs, credit report corrections, policy changes

Consumer Tribunals (NCAT, VCAT, QCAT):

- Scope: Contractual disputes, consumer guarantee issues, and unlicensed collectors

- Monetary Limits: $10,000-$40,000 depending on state

- Process: Formal hearing with binding decisions

- Remedies: Orders for payment, debt cancellation, damages for harassment

Comparison Table:

| Factor | AFCA | Consumer Tribunal |

|---|---|---|

| Cost | Free | $50-$200 filing fee |

| Formality | Less formal process | Court-like proceedings |

| Speed | 30-90 days typical | 2-6 months typical |

| Scope | Financial services only | Broader consumer issues |

| Appeal | Limited review options | Can appeal to a higher court |

Case Study Example: Sarah disputed a $3,000 credit card debt being pursued by a collection agency. The original bank had closed her account due to alleged missed payments, but Sarah had bank statements proving payments were made.

- AFCA Route: Complaint against both the bank and the collection agency resulted in debt cancellation and $500 compensation for stress, resolved in 6 weeks

- Tribunal Alternative: Would require separate cases against bank and collector, taking 3-4 months with uncertain compensation

When to Choose Each Option:

- Use AFCA when: The collector is licensed, the dispute involves credit or financial services, you want free resolution

- Use Tribunals when: Collector is unlicensed, seeking damages for harassment, AFCA lacks jurisdiction

Step 7: Long-term Protection and Credit File Management

Resolving the immediate collection issue is only part of protecting your financial future. Taking proactive steps to monitor and protect your credit profile prevents ongoing problems.

Credit Report Management:

- Free Annual Reports: Available from Equifax, Experian, and Illion

- Monthly Monitoring: Consider paid services during active disputes

- Dispute Incorrect Listings: Challenge defaults that breach notification requirements

- Positive Credit Reporting: Ensure current accounts show good payment history

Immediate Protection Steps:

- Credit Report Check: Review for unauthorized inquiries or incorrect defaults

- Identity Monitoring: Watch for signs of identity theft or fraud

- Bank Account Security: Monitor for unauthorized direct debits

- Address Updates: Ensure collectors have current contact details

Long-term Financial Health:

- Budget Planning: Create sustainable repayment plans for legitimate debts

- Emergency Fund: Build savings to avoid future collection issues

- Professional Advice: Use free services when needed

Free Help Services:

- National Debt Helpline: 1800 007 007 for free financial counseling

- Community Legal Centers: Free legal advice in your area

- Financial Counseling Australia: Professional debt and budgeting assistance

- ASIC MoneySmart: Educational resources and calculators

Warning Signs to Monitor:

- Unexpected credit report enquiries

- Default listings without proper notice periods

- Collection attempts on previously resolved debts

- Identity theft indicators in credit files

Bankruptcy Considerations: Before collection issues escalate to bankruptcy threats, understand that:

- Most collection debts don’t warrant bankruptcy proceedings

- Creditors must prove inability to pay through other means

- Professional advice is essential before considering bankruptcy as an option

FAQs

Can debt collectors contact me at work or speak to family members?

Debt collectors can contact you at work only if they cannot reach you elsewhere and your employer permits it. They cannot discuss your debt details with family members, employers, or friends without your written consent, except in very limited circumstances.

How long do debt collectors have to pursue a debt in Australia?

Most debts have a limitation period of 6 years in Australia, though this varies by state and debt type. However, acknowledging a debt or making partial payments can reset this timeframe. Collectors can still contact you about statute-barred debts, but cannot legally enforce payment.

What happens if I ignore debt collectors completely?

Ignoring legitimate debt collectors can lead to default listings on your credit report, legal action, and potential garnishment of wages or assets. However, you’re not required to engage until they provide proper debt verification. It’s better to dispute questionable debts in writing than ignore them entirely.

Can debt collectors take money directly from my bank account?

No, debt collectors cannot access your bank accounts without a court order or your explicit authorization. Be wary of collectors requesting direct debit authorities, and never provide bank details until you’ve verified the debt and agreed to payment terms in writing.

Do I have to pay collection agency fees on top of the original debt?

Collection fees are generally only recoverable if they’re reasonable and the original contract or law permits them. Many collectors add excessive fees that aren’t legally enforceable. Always request a detailed breakdown and dispute unreasonable charges as part of your debt verification process.

Conclusion

When debt collectors contact you, remember that knowledge is your best protection. By following these 7 steps – verifying debts, disputing incorrect amounts, documenting everything, and knowing your escalation options – you can handle collection attempts confidently and legally.

Use the phone scripts and dispute letter templates provided to protect your debt collectors Australia rights from the first contact. Don’t hesitate to escalate to AFCA or consumer tribunals when collectors breach rules or refuse to verify disputed debts properly.

Most importantly, seek help from free services like the National Debt Helpline or community legal centres if you feel overwhelmed. You have strong legal protections, and taking action early prevents minor issues from becoming major financial problems.